Auto Insurance in and around Snellville

Auto owners in the Snellville area, State Farm can help with your insurance needs.

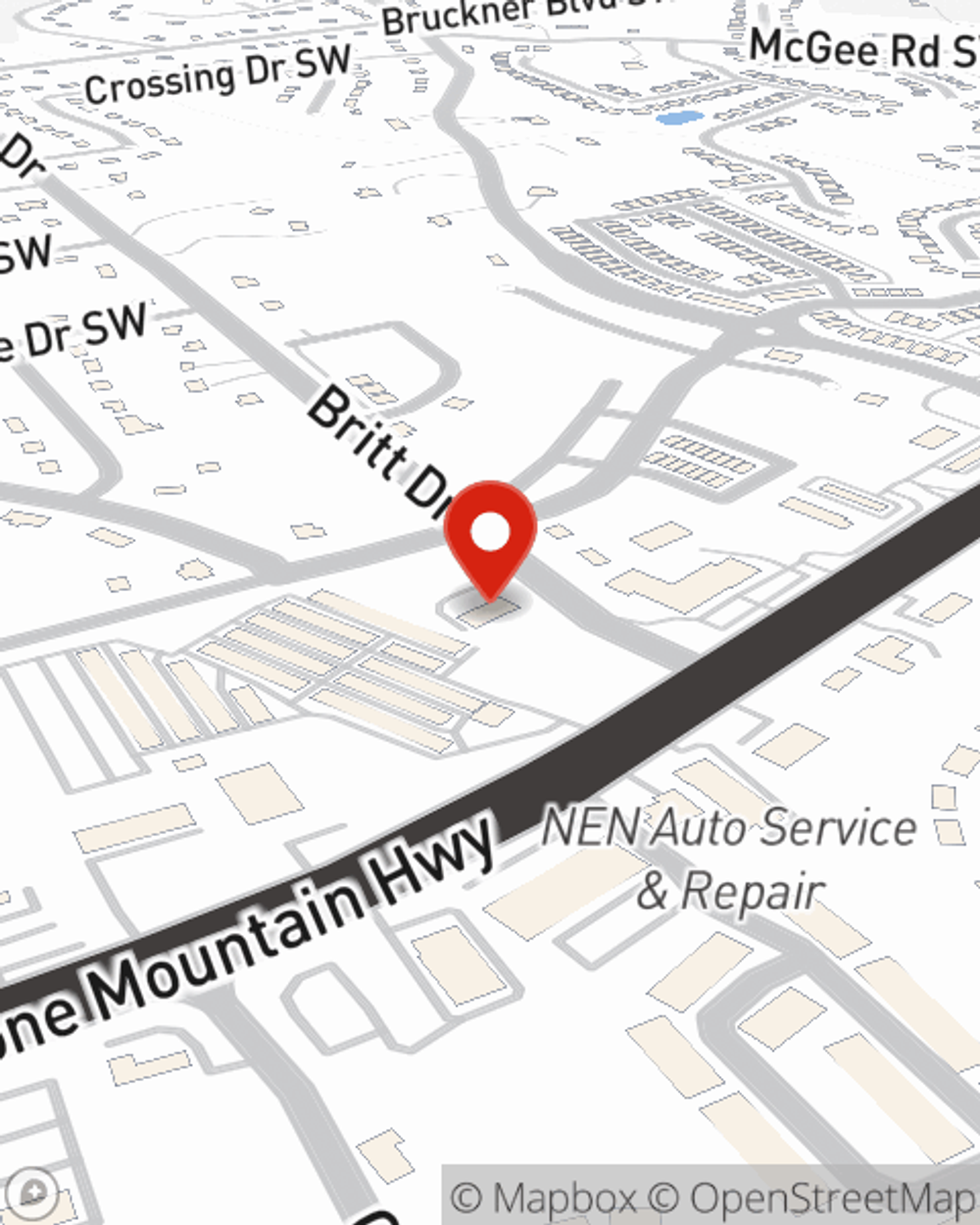

Take this route for your insurance needs

Would you like to create a personalized auto quote?

Be Ready For The Road Ahead

When it comes to reasonably priced car insurance, you have plenty of choices. Sorting through coverage options, providers, deductibles… it’s a lot, to say the least.

Auto owners in the Snellville area, State Farm can help with your insurance needs.

Take this route for your insurance needs

Your Hunt For Auto Insurance Is Over

But not only is the coverage fantastic with State Farm, there are also multiple options to save. This can range from safe driver savings like Steer Clear® to safe vehicle discounts like a passive restraint discount. You could even be eligible for more than one of these options! State Farm agent Josh Minore would love to verify which you may be eligible for and help you create a reliable policy that's right for you.

Do you also need protection for your commercial auto or electric and hybrid car? Would you be interested in emergency road service coverage or rental car coverage? Or are you simply worried about when mishaps occur? State Farm agent Josh Minore offers considerate attentive care to help address your needs. Visit the office to get started today!

Have More Questions About Auto Insurance?

Call Josh at (770) 982-7373 or visit our FAQ page.

Simple Insights®

Bike to work? Boost your commuting safety

Bike to work? Boost your commuting safety

Bicycle commuting can be beneficial to your health as well as the environment. If you bike to work, learn how to stay safe on your two-wheel commute.

What does liability insurance cover?

What does liability insurance cover?

Discover what liability car insurance covers, including bodily injury (BI) and property damage (PD), with examples of covered expenses.

Josh Minore

State Farm® Insurance AgentSimple Insights®

Bike to work? Boost your commuting safety

Bike to work? Boost your commuting safety

Bicycle commuting can be beneficial to your health as well as the environment. If you bike to work, learn how to stay safe on your two-wheel commute.

What does liability insurance cover?

What does liability insurance cover?

Discover what liability car insurance covers, including bodily injury (BI) and property damage (PD), with examples of covered expenses.